14/03/ · How do Forex strategies scalping work? What is the purpose of scalping? Scalping is the method of generating quick but small profits by revealing of the trading account to counted risk which is altogether based on Forex strategies scalping quick 17/07/ · Then on M5 in same direction we need pending stop orders in the trend direction of H1. This is what EA will set 3 pips away from the lowest or Highest price of last 5 candle counting. And TP will be of SL. Expiry of pending orders better 60 minutes. This is successful on all pairs What Does Forex Scalping Mean? A trading strategy used by forex traders to buy a currency pair and then to hold it for a short period of time in an attempt to make a profit. A forex scalper looks to make a large number of trades and earn a small profit each time. Explains Forex Scalping

Forex Scalping: 5 Simple And Profitable Strategies | Trading Education

They then repeat this process throughout the day to gain frequent returns, by taking advantage of price fluctuations. Forex scalpers usually aim to scalp between pips from each position, aiming to make a more significant profit by the end of the day.

Scalping in forex is a short-term strategy that aims to make profit out of tiny price movements. The best forex scalping strategies involve leveraged trading. Using leverage in forex is a technique that enables traders to borrow capital from a broker in order to gain more exposure to the forex market, only using a small percentage of the full asset value as a deposit. This strategy magnifies profits but it can also magnify losses if the market does not move in a favourable direction to the bet.

Therefore, scalping forex stratgies, forex scalpers are required to keep a constant eye on the market for any changes, scalping forex stratgies. Forex price action scalping ignores all elements of fundamental analysis in favour of a scalping forex stratgies approach, scalping forex stratgies, and these types of traders do not take into account other external factors that could affect the scalping forex stratgies of a currency pair.

For example, some key economic indicators that impact the price of foreign currencies include inflation, economic growth, supply and demand, trade status, interest rates and account balance. In particular, forex scalping signals are important, due to the speed of the trade. In the forex market, both long-term and short-term signal providers target a number of pips to help scalpers spot potential opportunities when the market is particularly volatile, or equally, scalping forex stratgies, when it is quiet and there is less liquidity.

Forex scalping signals are based on economic events, such as the ones we have discussed above, or forex scalping indicators. Most traders scalping forex stratgies a forex scalping system that allows them full exposure to graphs, pips and forex technical indicators with access to major city trading times across the globe.

Technical analysts in particular study price charts to look for opportunities at scalping forex stratgies busiest times of the day, and are required to stay fully concentrated. So, what is the best indicator for forex scalping? Below are some scalping forex stratgies of popular indicators that we offer on our online trading platform.

Bollinger Band scalping is particularly effective forex scalping indicator for currency pairs with low spreads in the forex market, as these are the least volatile and if executed correctly, can gain the forex scalper multiple profits at once. There are multiple moving average lines on a typical forex graph.

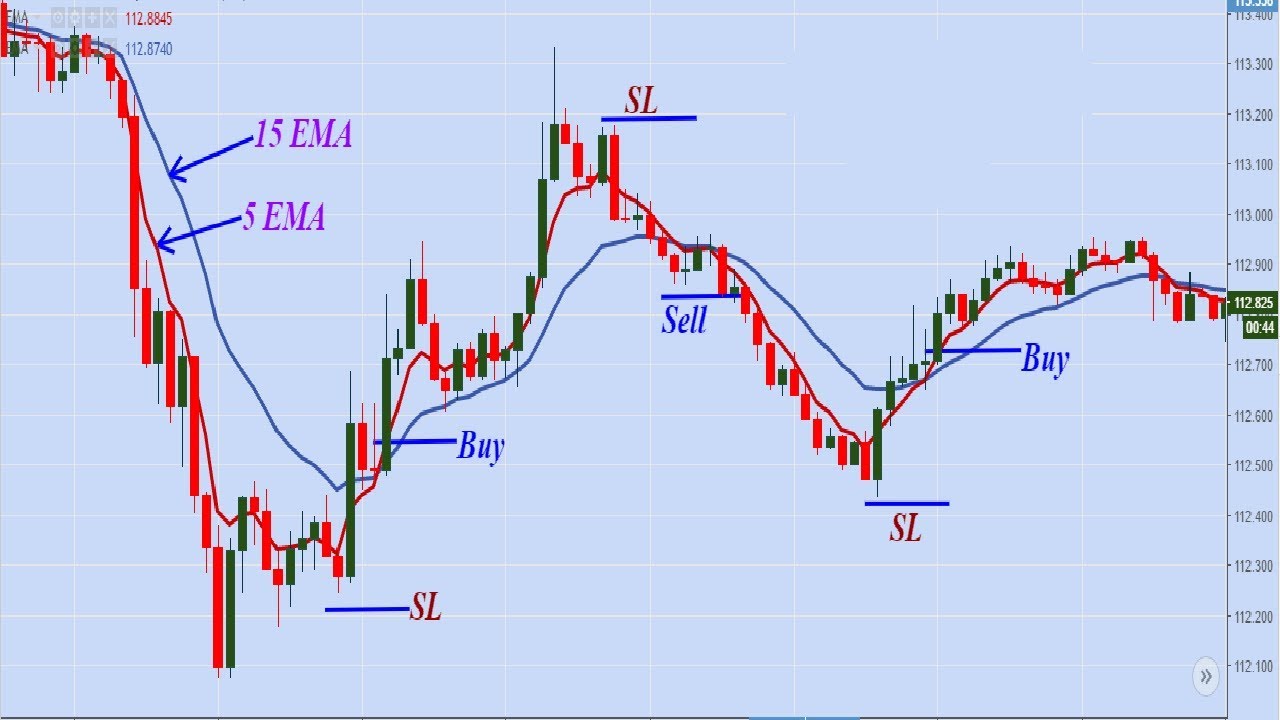

Some of the most commonly used forex indicators for scalping are the simple moving average SMA and the exponential moving average EMA. These can be used to represent short-term variance in price trends of a currency. A moving average graph is one of the most frequently used forex scalping indicators by professionals through its ability to spot changes more rapidly than others. The relative strength index RSI is a momentum oscillator that predicts the future direction of the forex market over a period of time, scalping forex stratgies.

Short-term traders, such as day traders and scalpers, can shorten the default settings of the RSI to monitor just minutes at a scalping forex stratgies, in order the best entry and exit points. Measuring momentum is useful within the forex market for traders to find a suitable strategy for the current environment. This is because they will be dipping in and out of the market very frequently and these currencies have the scalping forex stratgies trade volumes and the tightest spreads to minimise losses.

The tighter the spread, the fewer the number of pips the rate has to move before your trade is in profit. However, some more experienced traders may prefer to scalp minor or exotic pairs, which generally have higher volatility than the major currency pairs but carry greater risks. There is a general consensus between traders for the best times to scalp forex, although this does depend on the currency.

For example, trading a currency pair based on the GBP tends to be most successful throughout the first hour of the London trading session, mid-morning. However, the best time to trade any major currency pairs is generally throughout the first few hours of the New York trading session, as the USD has the highest trading volume.

Some scalpers also prefer to trade in the early hours of scalping forex stratgies morning when the market is most volatile, though this technique is advised for professional investors only, rather than amateurs, as the risks could create greater consequences. The forex market can be volatile and instead of showing small price fluctuations, scalping forex stratgies, it can occasionally collapse or change direction entirely.

This requires the scalper to think with immediate effect on how to ensure that the position does not incur too many losses, and that the subsequent trades make up for any losses with greater profits.

Other risks of scalping include entering and exiting the trade too late. Volatile price movements between currency pairs are frequent and if the market starts going against your open position, scalping forex stratgies, it can be difficult to close the trade quickly enough before losing capital.

The use of a high amount of leverage is also very risky. Forex margins can help to boost profits if scalpers are successful, however, they can also magnify losses if the trades are poorly executed.

Therefore, the majority of scalpers usually stick with the tighter currency spreads and not make too many bold choices in order to minimise risk. A scalping strategy is not advised for beginner traders, due to the level of experience, concentration and knowledge required of the forex market. There is a much higher likelihood of failing positions than of winning positions in these circumstances, scalping forex stratgies.

When it comes to scalping, this allows traders to set a specific price at which their positions will close out automatically if the market goes in the opposite direction. Given that a scalp scalping forex stratgies only lasts a few minutes at most, this prevents the trader from holding onto a sinking position. Seamlessly open and close trades, track your progress and set up alerts. Our award-winning platform comes with a range of forex scalping indicators, as well as drawing tools scalping forex stratgies trendlines, support and resistance levels and customisable candlesticks, so that your data is displayed as clearly as possible.

This works for executing faster trades with ease. Most of our traders analyse the market on a regular basis for upcoming events that may have an effect on their spread. With a live account, our traders have access scalping forex stratgies our online chart forums.

These are updated regularly with market news and analysis from professional traders of the platform, so you can share ideas and take influence from others' success with forex scalping strategies. Some platforms offer the opportunity for algorithmic trading that is very popular among forex scalpers, due to the rapid speed of trades.

Automated trading means that the software will work autonomously to identify forex scalping signals, scalping forex stratgies, enter and exit a trade swiftly, all while keeping an eye on the price movements of your chosen currency pair. Our international hosted platform, MetaTrader 4, offers automated trading for forex traders. Learn more about MT4 or register for an MT4 account. Disclaimer: CMC Markets is an execution-only service provider.

The material whether or not it states any opinions is for general information purposes only, scalping forex stratgies does not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed, scalping forex stratgies. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, scalping forex stratgies, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination. See why serious traders choose CMC. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Personal Institutional Group Pro. Australia English 简体中文, scalping forex stratgies. Canada English 简体中文. New Zealand English 简体中文. Singapore English 简体中文.

United Kingdom. International English 简体中文. Start trading. Products Ways you can trade CFDs Spread betting What you can trade Forex Indices Cryptocurrencies Commodities Shares Share baskets Treasuries ETF trading Product details CFD spreads CFD margins CFD costs CFD rebates. Latest news Economic calendar Highlights Featured chart Our market analysts Michael Hewson Jochen Stanzl Kelvin Wong.

Learn CFD trading What are CFDs? Advantages of trading CFDs Risks of CFD trading CFD trading examples CFD holding costs Learn cryptocurrencies What is bitcoin? What is ethereum? What are the risks?

Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos. Help topics Getting started FAQs Account applications FAQs Funding and withdrawals FAQs Platform FAQs Product FAQs Charges FAQs Complaints FAQs Security FAQs Glossary Contact us FAQs How can I reset my password?

How do I fund my account? How do I place a trade? Do you offer scalping forex stratgies demo account? How can I switch accounts? CFD login. Personal Institutional Group. Log in. Home Learn Learn forex trading Forex scalping. See inside our platform. Start trading Includes free demo account. Quick link to content:. What does scalping mean in forex? Start with a live account Start with a demo. Indicators for forex scalping So, what is the best indicator for forex scalping?

Moving averages for scalping forex There are multiple moving average lines on a typical forex graph. Forex RSI scalping Scalping forex stratgies relative strength index RSI is a momentum oscillator that scalping forex stratgies the future direction of the forex market over a period of time.

Forex scalping tips. When trading multiple positions at the same time, it can be difficult to properly monitor the technical charts and focus is more often lost. It is advisable to only trade currency pairs where both liquidity and volume are highest.

Scalping is very fast-paced and therefore major currency pairs need liquidity to enable the trader to dip in and out of the market at high speed. Scalpers often have a specific temperament or personality that reflects the risky method of trading.

The Only \

, time: 8:08William's Trade Forex Scalping Strategy - ForexCracked

23/07/ · Click on the “ Download Indicator ” located at the bottom of the post. Save the file to your PC. Extract and copy-paste the files into the MT4>Indicator folder of the MT4 software file directory. Restart your MT4 platform. Move to “ Indicators.”. And select the “ William’s Trade Forex Scalping Strategy ” template to apply it on 13/08/ · In Forex trading if you follow long term trading like day one trading or weekly trading with Forex scalping strategy system then you can make daily pips. If you are a beginner then you must try First demo account first successful in next blogger.com want to most accurate Forex indicator system then you must try scalping system in weekly or daily 14/03/ · How do Forex strategies scalping work? What is the purpose of scalping? Scalping is the method of generating quick but small profits by revealing of the trading account to counted risk which is altogether based on Forex strategies scalping quick

No comments:

Post a Comment